Online Services–

View, download or print an electronic version of your statement that looks just like the paper version you wait for monthly in your mailbox. Reduce your impact on the environment and save the $2 monthly printed statement fee. Plus you’ll enjoy these hassle-free benefits:

- Access up to 7 years of statements—anytime, anywhere

- Get email alerts when the statement becomes available

- Relax knowing your account information is safe and secure

- Helps keep you organized by eliminating the paper

Log into online banking today to quickly and easily sign up for Columbine’s eStatements.

Columbine is always open – just a click away. Do everything you would at a branch…online!

- Check balances in real time

- Transfer funds (including transfers to/from your accounts at other financial institutions)

- Send money to other Columbine members instantly

- Check transaction history

- Export to Quicken®

- View cleared check images

- Pay bills and added payees (must enroll in free BillPay)

- Send payments to family and friends using the Bill Pay P2P feature.

- View payee bills within Bill Pay with eBill.

- Make payments easily through Alexa with QuickPay.

- View eStatements

- Set up alerts

- Apply for loans

- Check loan rates

- and more… (we could go on and on but we think you get the point…)

It’s easy and convenient to manage all your funds without having to visit a branch. So, scratch that errand, walk down the hall, or car ride off the to-do list. Sit back, relax, you don’t have to go anywhere to manage all your finances.

Enroll Today! or Login through our homepage.

You’ll need your Columbine Member Number, your Last Name, the last five digits of your Social Security Number and your Date of Birth.

Please Note: if you are registering a child or a joint account, please use the Primary Member’s information.

Life is hectic, we know, we’re people just like you. With CFCU.me on your smartphone or tablet, you’ll have access to your accounts anytime, anywhere. It’s literally like having us in your back pocket! It’s fast, free, secure and available to all of our Online Banking users.

- Check balances

- Transfer funds (including transfers to/from your accounts at other financial institutions)

- Perform member to member transfers (send money to another member of Columbine instantly)

- Pay bills (must enroll in free BillPay)

- View pending transactions

- View transaction history

- Send and receive secure messages and alerts

- Access branch hours and location information

Starting taking us with you today!

![]()

![]()

Account eligibility requirements may apply. The Google Play™ store is a trademark of Google LLC. The App Store® is a trademark of Apple Inc.

Enjoy fast, free, easy and secure checkouts with our digital wallet solutions! Access your Columbine VISA Debit or Credit Card via your Apple, Android, or Samsung smartphones. It’s easy to add your Columbine Visa debit or credit cards to your phone’s wallet! Here’s all the how-tos you need to get started.

Apple

- On your Apple device, open the Wallet app and tap the plus sign.

- Type in your card information, or use your device’s camera to capture an image which will automatically enter your card information. Verify the information is captured correctly before continuing. Please note that the default card image may differ from your actual card.

- Set your Columbine Visa Card as your default card. Go to Settings, then Wallet & Apple Pay, tap Default Card and select your Columbine Visa Card.

- Place your device near the contactless reader with your finger on Touch ID.

- You’ll know payment is received when you feel a vibration and hear a beep.

Google Pay/Android Pay

- Download Google Pay from the Google Play App Store.

- Open the app and tap “Add Credit or Debit card.”

- You can choose cards already associated with your Google Account or add a new one. Agree to the terms and conditions that pop up. Then verify your card via email (you’ll receive a number to enter into the app)

- That’s it! Now, the next time you see a card reader with the Android Pay logo, just open the app, choose your card, and tap to pay.

Samsung Pay

- Open up Samsung Pay, which should be pre-installed on your Samsung smartphone. You can also get it here.

- If you’re prompted to sign in, use your Samsung account credentials or create an account. This is where you’ll also create a PIN for accessing your cards before payment.

- Tap credit/debit cards and then tap “Add.”

- Use the camera viewfinder to center your credit card. This allows your phone to capture the card number, expiration date and your name. You can also enter this in manually.

- Next add in the verification code.

- Now you’re ready to go. Samsung lets you swipe up from the bottom of the home screen to easily access your cards when you’re ready to pay, and you’ll verify your identity with a pre-set pin code or your irises.

Loan Payment Options–

Everyone that has a loan with Columbine is also a member with a primary share savings account and has the ability to set up online access for FREE. Payments on any Columbine loan can be made with a Columbine account by logging into Online Banking.

Once logged in, click on transactions, click on funds transfer, and set up the transfer from your account. Payments post immediately for free to your loan on the day you select, allowing you the luxury of last- minute payments without fees.

To transfer funds from another financial institution to a Columbine loan, click on transactions and then on add external account. Fill out all the necessary information and follow the instructions to link your outside account to Columbine.

A hosted, secure service that provides you with options for making a loan or credit card payment. This service gives you the ability to use your debit card (unlike Online Banking). This is a third party not operated by the credit union.

A convenience charge of $10.00 per transaction will be incurred.

Set up free, reoccurring payments from your chosen account to your loan on a certain day each month. It is a great way to make sure that your payments are posted on time and avoid unnecessary fees.

To set up an ACH automatic loan payment, please complete the ACH form and return it by fax, email, or to any of our branch locations.

Fax: (303)795-7751

Email: [email protected]

Phone

Call Columbine at (720) 283-2346 to make loan payments over the phone. A processing fee of $20.00 per transaction will be incurred.

All loan payment checks should be mailed to:

4902 E Dry Creek Rd. Centennial, CO 80122.

Please be sure to include your membership number and loan number on the check.

In-person

Hand deliver your loan payment to any of our branch locations for FREE! Or visit one of our shared branch locations. A shared branch is probably closer than you think, with over 100 in the Denver Metro area alone! Click here to find a shared branch near you.

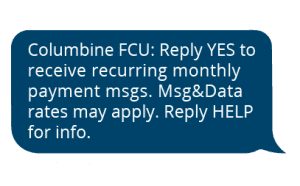

Do you find yourself missing payments for no reason other than that you forgot? We have your solution! PayPrompt™ is the free* payment reminder program that speaks your language – text!

With this awesome program, you’ll be able to quickly check an account balance, receive payment reminders and keep track of due dates.*

You should have received a message from the number 32576. Don’t worry, it’s not spam, it’s us! It will look something like this:

Be sure to reply YES to opt-in and start using this great service!

If you miss the first text and want to sign up later, don’t sweat. All you have to do it text ColumbineFCU to 32576. You’ll then be asked to opt-in by replying YES.

Insurances–

Home. Auto. Life. We’ve partnered with TruStage to give you access to special insurance discounts and top-notch service from a trusted source.

Auto Insurance

You bought the car with a great rate from Columbine, now get the car insurance at an equally great rate.

- 24-hour claims service

- eServices available anytime, anywhere

- Free, no obligation quote

Get more information or get your free quote today.

Home Insurance

Whether you own your home or are just renting, safeguard your home from the unexpected with a homeowner’s (or renters) insurance policy- powered by TruStage®.

- Convenient e-service to pay your bill, make changes to your policy, and even report a claim

- Fast, easy access to claims 24 hours a day

- Get a free, no obligation quote

Protect your stuff or get your free quote today.

Life Insurance

Life happens. It’s important to be prepared.

TruStage Guaranteed Acceptance Whole Life Insurance can help free your family from the burden of final expenses like mortgage payments, credit card debts or medical bills. It’s easy to apply—if you’re age 45 to 80, you can’t be turned down for any reason, not even your health.

With TruStage you can expect:

- Discounts on Term, Whole, and Guaranteed Acceptance Whole Life

- No medical exam

- Instant decisions

- Affordable rates

Learn more about safeguarding your family.

LEGAL: TruStage® life insurance is made available through TruStage Insurance Agency, LLC and issued by CMFG Life Insurance Company. Life insurance and AD&D insurance are issued by CMFG Life Insurance Company. Auto and Home Insurance Program is issued by leading insurance companies. The insurance offered is not a deposit and is not federally insured, sold or guaranteed by any depository institution. Product features may vary and may not be available in all states. Like other insurance, TruStage life insurance policies contain specific limitations, exclusions, termination provisions and requirements for keeping them in force. Please contact us for complete details.

At Columbine, we care about you and your family. We want you and your loved ones to get all the benefits possible in the event of a tragic occurrence in your family.

That’s why we offer $1,000 in Accidental Death and Dismemberment Insurance, provided by CUNA Mutual Group, at absolutely no cost. All you do is claim it.

- Insure you, your spouse, children, and children by guardianship

- No health exam

- Quick claim process

Financial Planning–

Consumers United Association (CUA)

Empowering Consumers

Based on the premise that we can do more together than individually, CUA helps and educates our members and advocates for consumers to ensure better financial futures for all. Becoming a CUA member gives you the power to make informed consumer and financial decisions while we advocate for policies that will have a positive impact on your finances. As a member, you will have access to financial tools and resources that can improve your budget, your credit and help you to plan for the future.

CUA Member Benefits:

Members of Consumers United Association enjoy the following benefits:

- An opportunity to voice your opinion on current issues which impact consumers’ personal finances. Send us your comments and opinions on financial related issues

- Assistance in resolving consumer problems through useful materials and personal mediation using our Complaint Resolution form.

- The opportunity to participate in special events offered by our sponsoring credit unions.

- A regular newsletter focusing on consumer-oriented, financial-related topics

- The ability to provide input to the Consumers United legislative efforts by joining our legislative committee or providing us with feedback about the issues that concern you.

- The option to join a credit union of your choice.

- The ability to voice your opinions on issues that impact your finances