Call to Order

Chairman Deb McBride called the meeting to order at 6:08 pm. She welcomed the Credit Union’s volunteers, staff, and guests to the 67th Annual Meeting of Columbine Federal Credit Union.

Appointment of Recording Secretary

Chairman Deb McBride appointed Chris Wiant as the recording secretary.

Determination of a Quorum

Chairman McBride asked the clerk, Tammy Weigel, if there was a quorum present. Weigel confirmed that a quorum was present.

Meeting Agenda

Brent Fischer moved to adopt the agenda as presented. Warren Brown seconded the motion, and the motion carried.

Approval of the Minutes of the 66th Annual Meeting

Chairman McBride asked for a motion to dispense with the reading of the meeting minutes from the 66th Annual Meeting dated March 9, 2023, and approve as presented. The motion was made by Laurie Kuntz and seconded by Warren Brown. The motion carried.

Old Business

Chairman McBride asked if there was any old business to report. Arick Williams responded that there was nothing to report.

Reports

Chairman McBride thanked the members for attending the 67th Annual Meeting of Columbine Federal Credit Union via Zoom due to the unsafe weather conditions. She then presented the 2023 Board of Directors Chairman’s report and introduced the Board of Directors and the Supervisory Committee members that were present. Next,

Signed,

Deb McBride

Chairman

Chris Wiant

Recording Secretary

Chairman McBride introduced Arick Williams, who presented the President’s report and recognized the Credit Union’s staff and members in attendance. Chairman McBride then stated that the Treasurer’s and the Supervisory Committee’s reports were included in the Annual Report given to the members. At that time, a motion to dispense with the reading of the reports and approve them as presented was made by Brian Field. The motion was seconded by Brent Fischer. The motion carried.

New Business

Chairman McBride asked if there was any new business. No new business was identified.

Elections

Chairman McBride then introduced herself as the Chairman of the Nominating Committee. McBride presented the Committee’s report. She stated that there were three open Board positions, and the Committee nominated incumbents Brent Fischer, Chris Wiant, and Laurie Kuntz, each for a 3-year term. Chairman McBride then asked for nominations from the floor three (3) times. As there were no other nominations, a motion to accept the nominations as presented was made by Roberta Morrow and seconded by Warren Brown. The motion carried.

Volunteer Acknowledgement

At that time, Arick Williams recognized Deb McBride and her 17 years of service on the Board of Directors and many years as the Chairman through some challenging times. Chairman McBride thanked management for the recognition and noted it was a pleasure to serve Columbine and the membership.

Adjournment

There being no further business, the meeting adjourned at 6:26 pm.

Signed,

Deb McBride

Chairman

Chris Wiant

Recording Secretary

After the merger approval in October of 2023, the Credit Union didn’t have long to celebrate the many hours of hard work and due diligence before the focus shifted to moving the Porter Membership over to Columbine’s operating platforms in August 2024. A data conversion is a major undertaking that requires even more hours of hard work, testing, and preparing to limit operational impact. I’m very honored to say that the Credit Union team successfully navigated these challenges, and the operational impact was limited to just one day as anticipated.

Outside of the data conversion, the operating conditions for financial institutions in 2024 remained challenging. Most forecasts expected the Fed to cut rates in Q1, yet thanks to stubborn inflation, cuts were delayed until the end of Q3. As the past few years have conditioned us, the Credit Union’s Leadership Team remained adaptable and is proud to report that 2024 was a remarkable success.

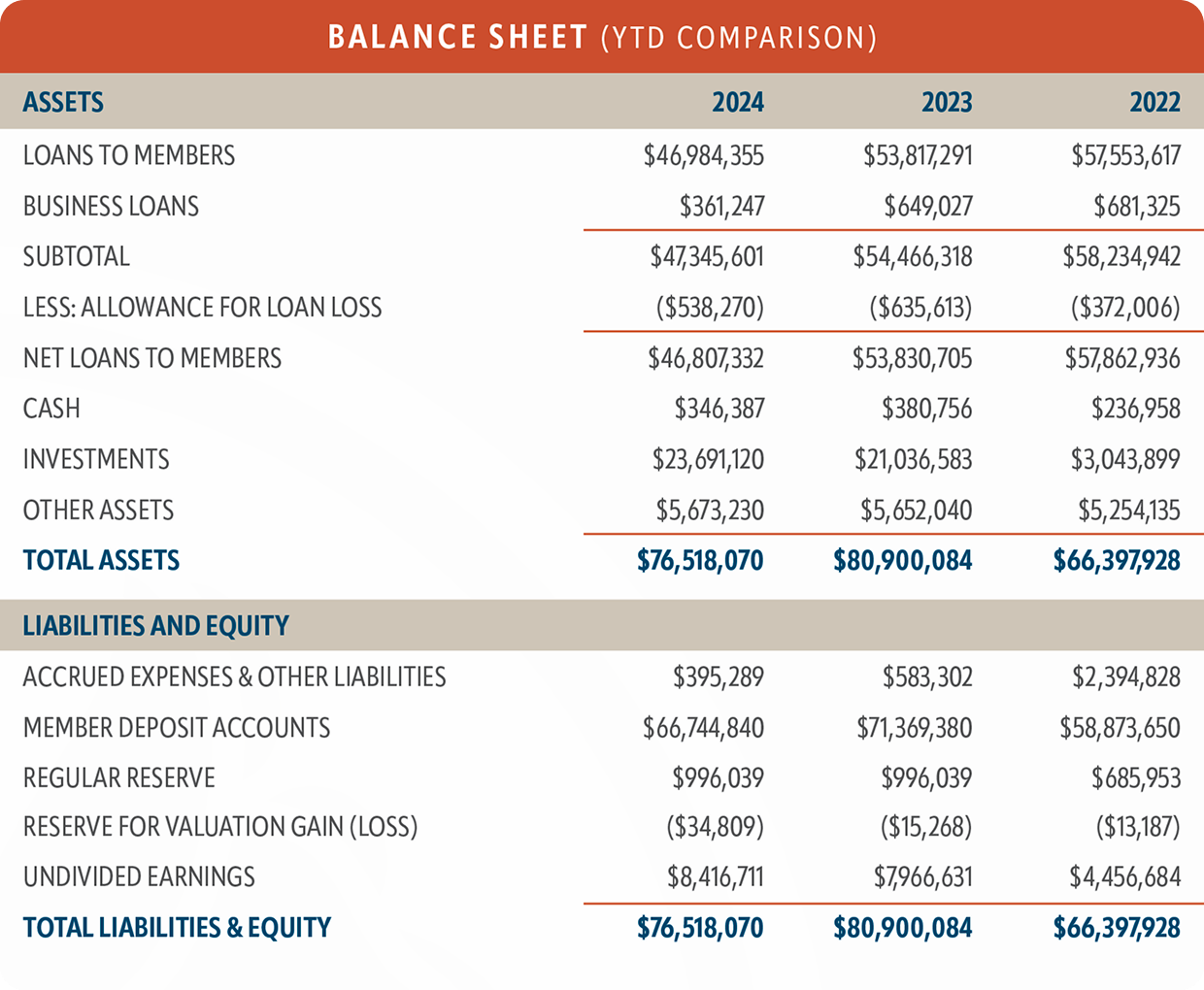

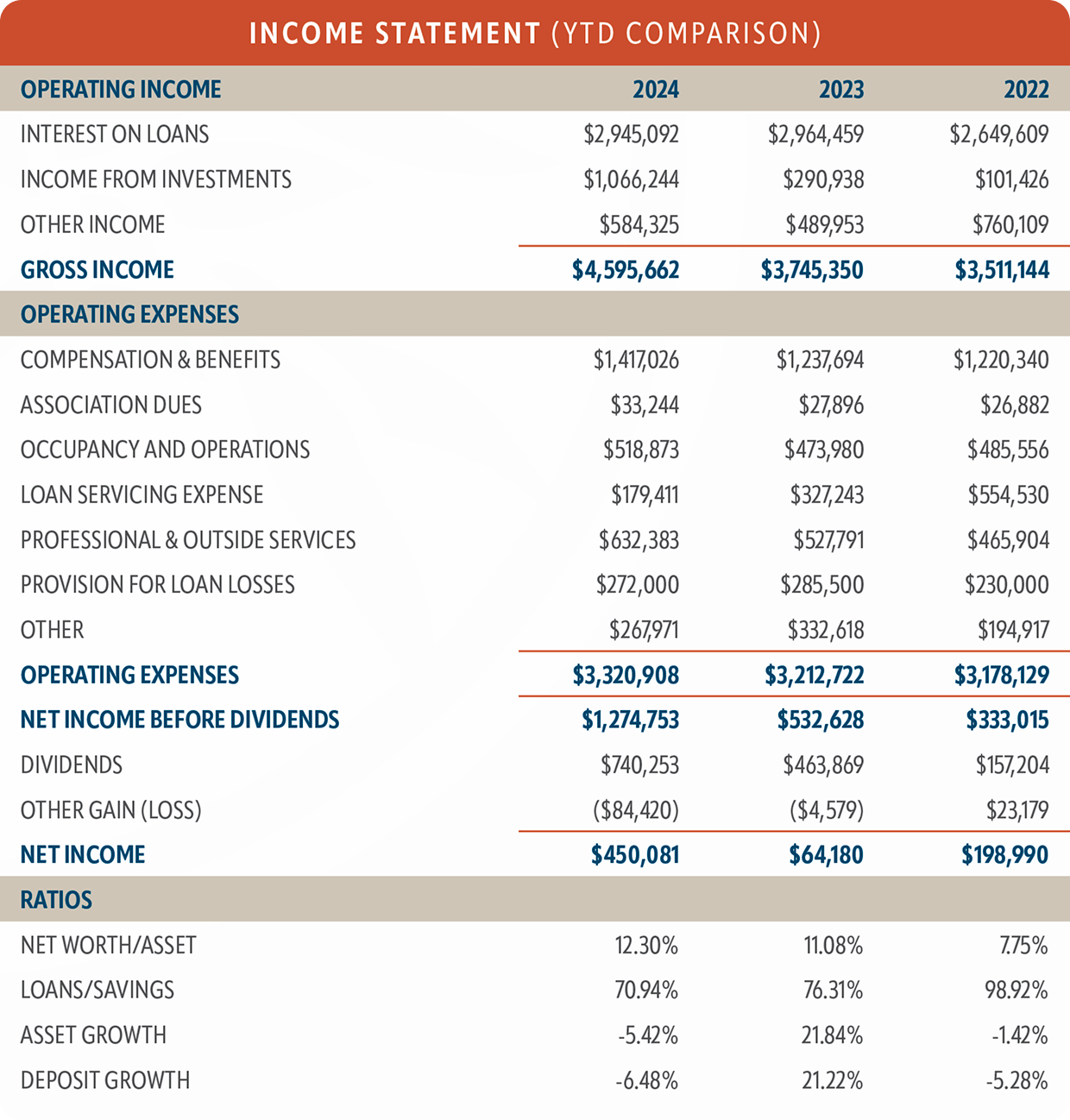

Financially, the Credit Union reported $450k in net income, while paying out over $740k in dividends to our 8,094 Members. In 2025, we anticipate that dividends may exceed $900k to Members, showing that Columbine remains committed to returning tangible value back to our Member-Owners. At the end of 2024, the Credit Union reported a capital ratio of 12.30%, which far exceeds our regulator’s threshold of 7.00% to be considered a well-capitalized or healthy credit union.

In addition, Columbine sponsored and supported local non-profits and foundations. Our community engagement in 2024 impacted several organizations, including the Columbine High School Frank DeAngelis Academic Foundation, Big Dogs Huge Paws, Zonta Club of Denver, Open Arms Food Bank, Family Tree Colorado, and schools including Arapahoe High School and Homestead Elementary. Furthermore, the Columbine Connects Foundation surpassed the $30k mark for scholarships distributed since its inception.

This type of success is only possible thanks to the support of many others. First, I want to thank the Volunteers for their continuous guidance and trust in the Executive Management Team. Our Volunteers willingly commit countless hours to ensure our financial co-operative fulfills our mission to help others achieve their financial dreams. This year I would like to take a moment to recognize Deb McBride for her 18 years of Board service and even more on various Committees. She has left an enormous imprint on Columbine as to what servant leadership means. We will truly miss her. Secondly, the Columbine Staff deserves high praise. They have the greatest impact on our Membership as the face and voice of the Credit Union, and their commitment to serve our members to the highest of standards is the leading force for the Credit Union’s success. Lastly, the biggest thank you goes to our Membership. I wholeheartedly thank our Members for their trust and support as we strive to live out our vision and mission for the Members of this financial co-operative and the communities we share.

Vision

Our vision is to be the leader in helping our members, employees, and community pursue their dreams.

Mission

We listen to your personal story and provide the tools and education you need to reach your dreams and succeed. When others don’t, we give a damn.

I would love to hear your story.

Arick Williams, MBA

President / CEO

I was honored to be elected as the Columbine Board Chair beginning in 2024. I followed in the footsteps of Deb McBride, who skillfully guided the work of the Board for many years. Deb’s leadership and commitment to Columbine over her many years of service have been exemplary.

2024 was another predictably unpredictable year for the Credit Union. We watched as inflation slowly retreated and waited for the Federal Reserve to announce interest rate reductions, which in turn could benefit consumer lending. Our Asset and Liability Management Committee (ALCO) met each month to review current data and make recommendations to the Board concerning loan and investment rates for Columbine. The goal was to ensure that our interest rates were competitive in the marketplace and served our Members’ needs.

Despite the year of uncertainty in the financial market, Columbine remained financially sound, with total assets of more than $76M and a strong net worth. We are pleased to report that our revenue for 2024 exceeded our budget estimates, and operational expenses were less than budgeted. We were able to reward members with over $740k in dividends in 2024. We are also pleased that our regulatory agency, the National Credit Union Administration (NCUA), completed a comprehensive review of the critical items of our operation and gave us a very good rating. Your credit union remains healthy and well-managed.

The Credit Union also supported a variety of community events in 2024. Those included the CO Motorcycle Expo, Columbine HS Run for Remembrance, Molly Dharma Run, Hoofin It in the Hollows 5K, Trick or Treat Street, and the Big Dogs Huge Paws Pictures with Santa. We also hosted our first Buzz Bash to celebrate our youth membership and our first Member Appreciation Tailgate.

My report wouldn’t be complete without acknowledging the commitment of the Member Volunteers and amazing staff who work with the Columbine leadership to serve our Members. Columbine staff are committed to providing great service to members each and every day. In this era where customer service is often forgotten in businesses it remains a high priority at Columbine.

Chris Wiant, M.P.H., Ph.D.

Board Chair

As the Treasurer of Columbine Federal Credit Union’s Board of Directors, I am pleased to report that 2024 was another successful year. Over the last year, Columbine Federal Credit Union was able to provide superior financial products to our Members while achieving continuous financial growth. The strength of the Credit Union is a testament to the loyalty and support that you, our Members, have consistently shown throughout the years.

From a financial perspective, the overall results were extremely positive. The Credit Union realized an increase in total equity while continuing to offer both competitive dividend rates on deposit accounts and interest rates on loans. At year-end, the Credit Union reported over $76M in assets, of which $47M were loans. Since loans allow us to provide a valuable return to Members, they are an essential part of the Credit Union’s success.

In addition, net worth is one of the primary indicators of whether a credit union is financially sound. The Credit Union ended the year above 12%, which anything above 7% is considered “well-capitalized” by the National Credit Union Administration and indicates that your Credit Union remains financially strong.

As your treasurer, I believe that my primary responsibility is to ensure funds and resources are properly allocated to serve the Membership. This year, as in past years, Columbine management gets high marks in this category. Thanks to their leadership, the Credit Union accomplished many of the goals outlined in its 2024 strategic plan, securing its ability to meet the needs of the Membership by offering the products and services that can help you achieve your financial goals. Columbine’s net income for the year outperformed the budget by over $310k because of their hard work and dedication.

The Asset Liability Committee meets monthly to review the financial markets and how changes in the equity and bond markets impact Columbine. The Committee also monitors local rates very closely to ensure that the Credit Union can quickly react to changes in dividend rates. This ensures that the Membership continues to earn competitive rates on their hard-earned deposits. As a result, the Credit Union paid out more than $740k in dividends to the Members.

With the hard work of the Credit Union staff and the support of our dedicated Volunteers, we look forward to continued growth and success in 2025. Together, we can build upon last year’s promising financial performance and secure a stronger, more vibrant Columbine, capable of serving our Member-Owners both now and in the future.

Brent Fischer

Treasurer

Columbine Federal Credit Union’s Supervisory Committee, made up of four Volunteer Members, independently evaluates the strength and soundness of Columbine’s operations and activities. The Committee, alongside the Board of Directors, the President, and the senior management team, with the assistance of independent auditors, assures that the Credit Union’s assets are safeguarded by upholding procedures that comply with Generally Accepted Accounting Principles (GAAP). The Committee also assures that Columbine’s financial statements provide a fair and accurate representation of the financial condition of the Credit Union.

Our independent auditor, Cornerstone Resources, conducted a comprehensive review of Columbine’s financial statements for the period ending September 30, 2024, and the related statements of income, changes in retained earnings, and cash flows for the year utilizing agreed-upon procedures. As of the writing of this report, the Supervisory Committee and Board of Directors await the final report; however, they have indicated their report will not include any significant issues with the areas of the Credit Union’s financials that were evaluated.

In addition to the annual agreed-upon procedures review, Cornerstone performed three internal reviews and the annual regulatory BSA/OFAC, ACH, and SAFE Act audits throughout the year. These are ongoing reviews and audits to ensure that the Credit Union’s policies and procedures are being followed and quality internal controls are in place. After each review and/or audit, Cornerstone provides a detailed report to the Supervisory Committee, the Board of Directors, and Management.

The National Credit Union Administration (NCUA), which is the regulatory agency for all federally chartered credit unions nationwide, performs periodic supervisory examinations. The last exam performed was on March 31, 2024. Based on this examination, they provided a report confirming that Columbine is prudently managed and is a financially sound institution.

Based on the results of the review of the agreed-upon procedures, the annual regulatory audits, the internal reviews, and the NCUA supervisory examination, as well as the internal control work that the Committee performs on a regular basis, it is the opinion of the Supervisory Committee that Columbine Federal Credit Union continues to be financially strong and well managed, with sound policies and programs. Columbine Federal Credit Union is also in compliance with the Credit Union’s by-laws and applicable federal and state laws and regulations.

The Supervisory Committee serves as your personal advocate determined to provide you with the highest-quality Member service and privileges. As committee members, we are proud to offer you a safe and sound environment to conduct your financial business. We look forward to serving you in the future.

Brian Field

Supervisory Committee Chairperson

Columbine Federal Credit Union provides links to web sites of other organizations in order to provide visitors with certain information. A link does not constitute an endorsement of content, viewpoint, policies, products or services of that web site. Once you link to another web site not maintained by Columbine Federal Credit Union, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy.

Click the link above to continue or CANCEL